Newsroom

- Hong Kong and Bangkok-based fintech startup Fraction received Thailand’s ICO Portal License from the SEC

- The Fraction platform will enable the listing and trading of asset-backed tokens representing ownership in underlying physical or digital assets

- The first assets planned for listing are iconic real estate properties, in partnership with leading developers Magnolia Quality Development Corporation (“MQDC”), Charn Issara (CI.BK) and Nirvana Daii (NVD.BK) (“NVD”)

- The company was founded 3 years ago by a former Managing Director and Partner at Lazard (LAZ.NYSE) and a serial tech entrepreneur

- Fraction is raising new capital to expand its platform, list new assets and enter international markets

September 16th, 2021

10am Hong Kong, 9am Bangkok

Fraction (Thailand) Co., Ltd., a wholly owned subsidiary of the Hong Kong-based fintech company Fraction Group is proud to announce it was awarded Thailand’s ICO Portal License, subject to activation approval, by the Securities Exchange and Commission of Thailand (SEC) to operate an asset-backed token offering service. The company has developed the world’s first unified platform which covers:

- Fully integrated initial digitization and fractionalization of an asset;

- Initial offering of those fractions to investors (“Initial Fraction Offering” or “IFO”);

- Secondary market trading of fractional tokens between investors;

- All related intermediary services covering the complete end-to-end journey.

With Fraction’s plug-and-play platform, individuals and companies can now invest, sell and manage fractional ownership of anything from a small stake in a city condominium, beachfront resort or art piece through to managing a private fund, assets and investors.

“We are proud to announce the first SEC-regulated unified platform that leverages the blockchain to digitize, list and trade tangible assets. After 3 years of laying the technical foundations and the real world legal structure, we have obtained regulatory approval and can now enable financial inclusion, letting small investors participate in attractive asset classes that used to be previously inaccessible.”, says Eka Nirapathpongporn, Co-founder and CEO of Fraction and former Managing Director and Partner at Lazard (LAZ.NYSE), a New York based global financial advisory and asset management firm.

“Fraction offers the first SEC-approved implementation of distributed ledger technology based on the Ethereum blockchain for managing multi-asset fractional ownership. We are glad to be forerunners in this convergence of finance and ledger technology. While many have been talking about it or trying to do it, our platform is completed, already up and running, and ready to list public assets.”, says Shaun Sales, Co-founder and CTO of Fraction.

First IFOs with Iconic Assets from Thailand’s Largest Developers

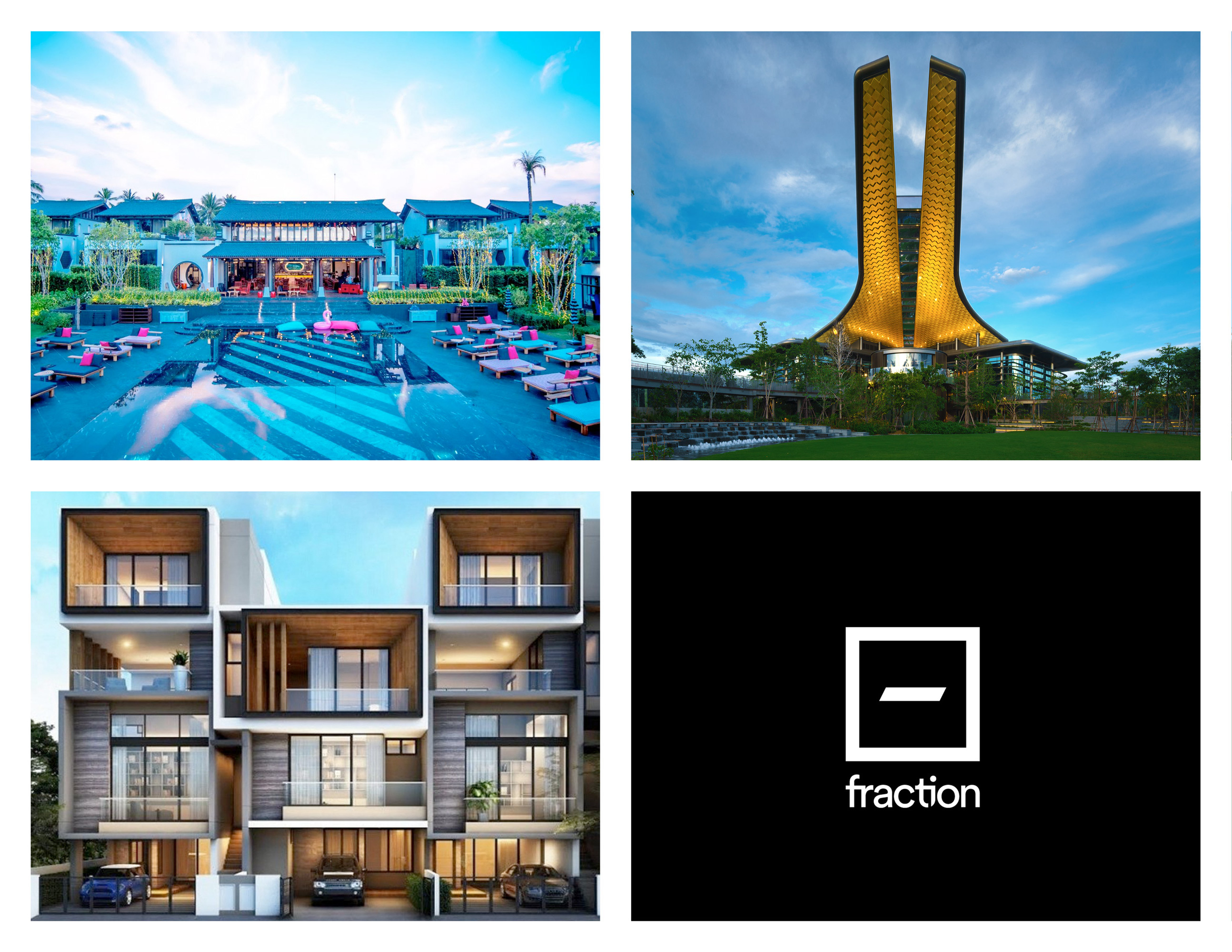

With its license in place in Thailand, Fraction has signed a memorandum of understanding with Magnolia Quality Development Corporation Limited (“MQDC”), Charn Issara Development Public Company Limited (“Charn Issara”) and Nirvana Daii Public Company Limited (“NVD”) (together “Launch Partners”), to explore an IFO of some of Thailand’s most iconic real estate projects with an aggregate value of over THB15 billion (US$462,000,000).

Democratizing Investment

With a world first offering of this kind, Fraction and its Launch Partners aim to rewrite the investment landscape which has locked the majority out of access to large capital asset investment.

Never before could an investor have the opportunity to invest as little as THB5,000 (~US$150) and own a part of high profile real estate projects such as:

- MQDC’s world renowned 350 million baht Penthouse Unit at the Forestias or the up-coming multi-billion baht Mulberry Grove Sukhumvit project;

- Charn Issara’s renowned resort projects such as Sri Panwa Phuket or Beach Front Villas at the Baba Beach Club Natai and Hua Hin;

- Key frontier development projects like Nirvana Beyond or Nirvana @work in the key growth corridor of Bangkok.

Commenting on this landmark event Mr Songkran Issara, Managing Director of Charn Issara, said “We have been working very hard to develop what we believe to be great investment opportunities in iconic locations around Thailand. In the past, these opportunities were not attainable by everyone, but now our younger generation who may have a greater connection to these types of assets can participate as investors too.”

Mr. Visit Malaisirirat, CEO of Magnolia Quality Development Corporation Limited (MQDC), said: “MQDC is delighted to partner with Fraction, a leader in financial technology. This collaboration is another important step for MQDC under our strategy of embracing and leading continuous innovation. For the first time in the world investors can buy and sell real estate through digital tokens on a unified platform encompassing all the steps, opening a customer-centric, inclusive way to own properties. We believe this model can drive real estate and many other industries in the future”

“We understand that investment opportunities have largely been reserved for those with a large capital base and that is why we see the wealth divide growing larger over the years. We have seen a lot of people talk about it but none are complete or ready to go. Now with Fraction, everyone can be part of the next wave of financial inclusion.”, added Mr. Sornsak Somwattana, CEO of NVD.

Just like global capital markets, secondary liquidity and trading play an important role in any investments after their public listing. KULAP, an SEC licensed Digital Asset Broker, will provide the initial secondary trading facilities post-IFO via a connection to the Fraction Global Liquidity Pool.

Subject to activation approval by the SEC, Fraction will be working with MQDC, Charn Issara and NVD to finalise the offering structures and Offering Documentation for IFO approvals with the SEC. Fraction expects the first IFOs to be open for subscriptions in Q1 2022.

Media Contact:

media@fraction.co

An investment in an uber-chic, modern renovation project in the heart of Bangkok's prime residential area is using Fraction as an ownership platform to address its investors' differing needs and position UTC for future growth.

UTC Holding is an investment company geared towards the real estate sector. UTC identifies, structures and leads the investment in various property projects on behalf of a set of privately pooled investors where its recent focus has been a series of renovated single homes in the upper class Ekkamai and Thonglor areas of Bangkok.

Using Fraction to Pivot

With increasing demand for flexibilities by its investors, UTC adopted Fraction as an ownership platform rather than using the traditional holding company structure for HQ12, the latest addition to its portfolio.

Powered by Fraction, UTC is able to provide unprecedented levels of freedom for its investors in terms of exit preferences and investment duration. This has provided a significant increase in the attractiveness of the fund, as well as reducing the level of administrative work and costs for UTC to manage the investment.

Geared for Future Growth

UTC sees the "HQ" project as a series investment where built up knowledge and experiences can offer significant synergies for the follow on renovation sites. However, each of UTC's investors often have differing ideas and differing levels of interest for each future site. A traditional holding company structure previously used doesn't offer the ability for each of UTC's investors to pick and choose how much they want to invest on each site unless a company is set up for each project separately - which represents a significant financial and administrative cost.

With Fraction, UTC can offer its investors the ability to pick and choose which project they like more or less as well as the flexibility of exiting on their own timeframe and terms.

The idea of being locked away in private funds is now a thing of the past.

Fraction has completed the successful Initial Fraction Offering (IFO) and listing on the Fraction Exchange of a condo unit in Onnut, Bangkok.

The complete journey of digitisation of the title deed and fractionalisation of its ownership was followed by the initial offering of the fractions, all provided and completed on the Fraction platform. Following the IFO, the fractions of UDON-0001, the name given to the asset, were admitted and quoted on the Fraction Exchange where they can now be traded amongst investors in our closed loop beta testing period.

UDON-0001 will be the first of many properties to be digitised and fractionalised by Fraction this year.

Get Started

Bring your fractional ownership idea to life. Get in touch with our team to

create a custom solution for your business.